The Inevitable Transformation of Private Capital Raising

2023-03-28

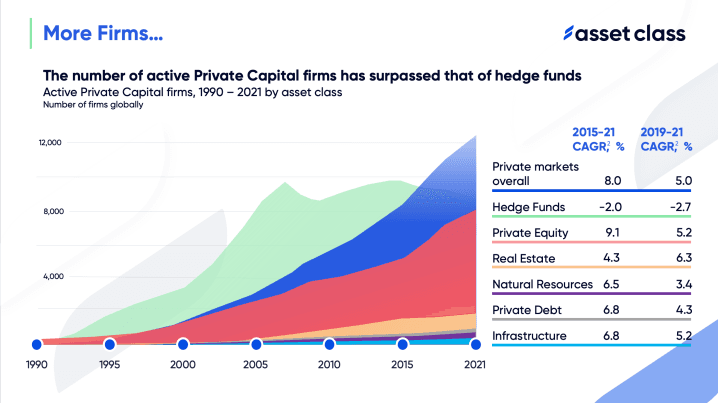

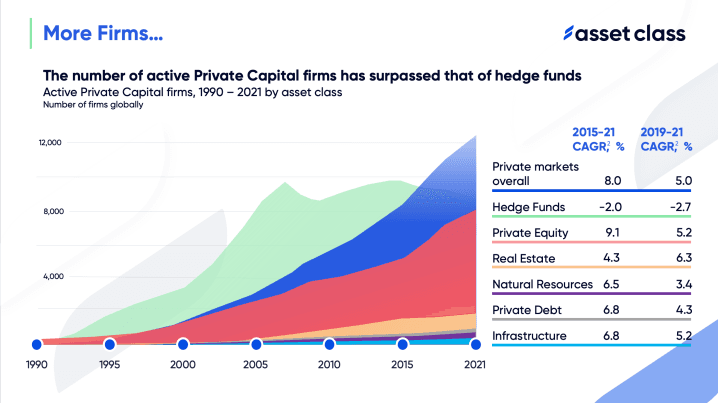

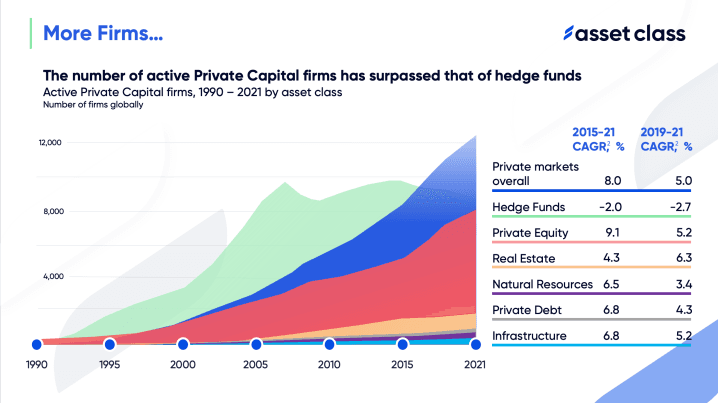

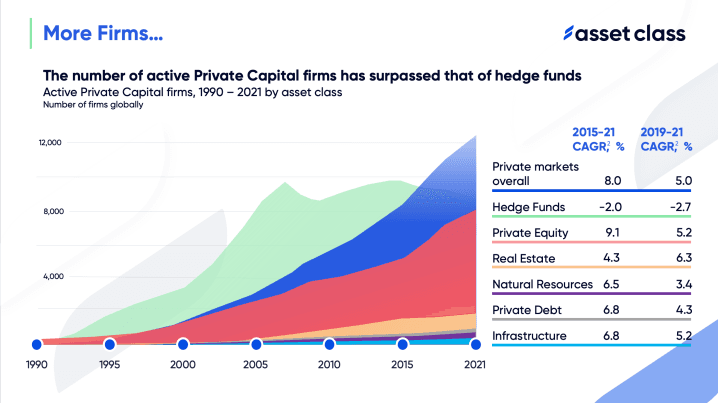

Take a look at the image below. This is the growth of active Private Capital firms from 1990 to 2021. Now take a look at just the past 6 years - from 2015 to 2021. That's an increase in the number of firms from circa 8,000 globally to over 12,000. In other words there has been a greater than 50% increase in the number of active firms in just 6 years.

Growth in private capital firms 1990 - 2021

Now take a look at the returns being delivered from the Private Markets (NAV), versus Public Markets (Market Cap), over a similar period. You can see that the pace of growth in Private Capital return is significant. Not only is it significant but it is significantly outpacing Public Market returns. Investors chase yield, they want returns, many want outsized, uncorrellated returns. This is where Private Capital is winning. These returns are causing seismic shifts in the way that investors view the private capital markets and the way in which Private Capital firms are responding.

Private Capital market returns versus Public market returns

Now let's look at just one of the ways Private Capital Firms have responded. In 2000, it was likely that a private capital firm had a highly specialized singular focus. In 2020, it's far more likely that they are a multi-offering, diversified (either at a sub-asset-class level, or at an Asset Class level) firm, seeking to provide an array of offerings to the significant number of newly accredited investors in the market. With 13% of all american housholds now meeting the 'Accredited Investor' criteria, there are a lot more investors, chasing returns and hungry for Private Capital offerings.

Product proliferation in Private Capital

And finally, let's look at allocations to private capital. They have steadily gained pace and continue to grow in percentage terms each year, with ranges from the early 20's to as high 50-60% with long-term patient capital. Private capital investments are on the rise, and both Private Equity and Venture Capital firms need to significantly transform their business to take advantage of these changes, and protect the clients they already have.

Allocations to Private Capital 2008-2019

How do PE and VC firms respond to this opportunity?

The answer is simple. You have to simplify and digitize your operations from end-to-end. Give these Investors the kind of service they expect and deserve. Think about their experience from the time that you first reach out to them to the time that they become an investor. In summary - you need to care about the overall experience they have with you as an investor.

We call this 'Investor Lifecycle Management' and the benefits are transformative for every stakeholder in the process.

Improved onboarding by 4-5X

Automate compliance by embedding it in your system processes

Improve access to your offerings by accellerating 'time to view' by 4-5X

Get Subscription Documents automated, pre-populated and signed quicker - 82% sign in less than 1 day

Reduce NIGO errors by 80+%

Faster Funding/Capital Calls, often 5-10X faster

Improve service and reduce your costs by 5-20X by streamling, automating and providing self-service options for your investors

Reduce the time it takes to get from 'Form-to-funded' from 6+ weeks to <5 Days

Below is a simplified step by step breakdown of each primary stage, the improvements that can be had with Investor Lifecycle Management, and the speed and efficiency with which you can raise capital.

Investor Lifecycle Management

Interested in learning more?

Take a look at the image below. This is the growth of active Private Capital firms from 1990 to 2021. Now take a look at just the past 6 years - from 2015 to 2021. That's an increase in the number of firms from circa 8,000 globally to over 12,000. In other words there has been a greater than 50% increase in the number of active firms in just 6 years.

Growth in private capital firms 1990 - 2021

Now take a look at the returns being delivered from the Private Markets (NAV), versus Public Markets (Market Cap), over a similar period. You can see that the pace of growth in Private Capital return is significant. Not only is it significant but it is significantly outpacing Public Market returns. Investors chase yield, they want returns, many want outsized, uncorrellated returns. This is where Private Capital is winning. These returns are causing seismic shifts in the way that investors view the private capital markets and the way in which Private Capital firms are responding.

Private Capital market returns versus Public market returns

Now let's look at just one of the ways Private Capital Firms have responded. In 2000, it was likely that a private capital firm had a highly specialized singular focus. In 2020, it's far more likely that they are a multi-offering, diversified (either at a sub-asset-class level, or at an Asset Class level) firm, seeking to provide an array of offerings to the significant number of newly accredited investors in the market. With 13% of all american housholds now meeting the 'Accredited Investor' criteria, there are a lot more investors, chasing returns and hungry for Private Capital offerings.

Product proliferation in Private Capital

And finally, let's look at allocations to private capital. They have steadily gained pace and continue to grow in percentage terms each year, with ranges from the early 20's to as high 50-60% with long-term patient capital. Private capital investments are on the rise, and both Private Equity and Venture Capital firms need to significantly transform their business to take advantage of these changes, and protect the clients they already have.

Allocations to Private Capital 2008-2019

How do PE and VC firms respond to this opportunity?

The answer is simple. You have to simplify and digitize your operations from end-to-end. Give these Investors the kind of service they expect and deserve. Think about their experience from the time that you first reach out to them to the time that they become an investor. In summary - you need to care about the overall experience they have with you as an investor.

We call this 'Investor Lifecycle Management' and the benefits are transformative for every stakeholder in the process.

Improved onboarding by 4-5X

Automate compliance by embedding it in your system processes

Improve access to your offerings by accellerating 'time to view' by 4-5X

Get Subscription Documents automated, pre-populated and signed quicker - 82% sign in less than 1 day

Reduce NIGO errors by 80+%

Faster Funding/Capital Calls, often 5-10X faster

Improve service and reduce your costs by 5-20X by streamling, automating and providing self-service options for your investors

Reduce the time it takes to get from 'Form-to-funded' from 6+ weeks to <5 Days

Below is a simplified step by step breakdown of each primary stage, the improvements that can be had with Investor Lifecycle Management, and the speed and efficiency with which you can raise capital.

Investor Lifecycle Management

Interested in learning more?

Take a look at the image below. This is the growth of active Private Capital firms from 1990 to 2021. Now take a look at just the past 6 years - from 2015 to 2021. That's an increase in the number of firms from circa 8,000 globally to over 12,000. In other words there has been a greater than 50% increase in the number of active firms in just 6 years.

Growth in private capital firms 1990 - 2021

Now take a look at the returns being delivered from the Private Markets (NAV), versus Public Markets (Market Cap), over a similar period. You can see that the pace of growth in Private Capital return is significant. Not only is it significant but it is significantly outpacing Public Market returns. Investors chase yield, they want returns, many want outsized, uncorrellated returns. This is where Private Capital is winning. These returns are causing seismic shifts in the way that investors view the private capital markets and the way in which Private Capital firms are responding.

Private Capital market returns versus Public market returns

Now let's look at just one of the ways Private Capital Firms have responded. In 2000, it was likely that a private capital firm had a highly specialized singular focus. In 2020, it's far more likely that they are a multi-offering, diversified (either at a sub-asset-class level, or at an Asset Class level) firm, seeking to provide an array of offerings to the significant number of newly accredited investors in the market. With 13% of all american housholds now meeting the 'Accredited Investor' criteria, there are a lot more investors, chasing returns and hungry for Private Capital offerings.

Product proliferation in Private Capital

And finally, let's look at allocations to private capital. They have steadily gained pace and continue to grow in percentage terms each year, with ranges from the early 20's to as high 50-60% with long-term patient capital. Private capital investments are on the rise, and both Private Equity and Venture Capital firms need to significantly transform their business to take advantage of these changes, and protect the clients they already have.

Allocations to Private Capital 2008-2019

How do PE and VC firms respond to this opportunity?

The answer is simple. You have to simplify and digitize your operations from end-to-end. Give these Investors the kind of service they expect and deserve. Think about their experience from the time that you first reach out to them to the time that they become an investor. In summary - you need to care about the overall experience they have with you as an investor.

We call this 'Investor Lifecycle Management' and the benefits are transformative for every stakeholder in the process.

Improved onboarding by 4-5X

Automate compliance by embedding it in your system processes

Improve access to your offerings by accellerating 'time to view' by 4-5X

Get Subscription Documents automated, pre-populated and signed quicker - 82% sign in less than 1 day

Reduce NIGO errors by 80+%

Faster Funding/Capital Calls, often 5-10X faster

Improve service and reduce your costs by 5-20X by streamling, automating and providing self-service options for your investors

Reduce the time it takes to get from 'Form-to-funded' from 6+ weeks to <5 Days

Below is a simplified step by step breakdown of each primary stage, the improvements that can be had with Investor Lifecycle Management, and the speed and efficiency with which you can raise capital.

Investor Lifecycle Management

Interested in learning more?

Take a look at the image below. This is the growth of active Private Capital firms from 1990 to 2021. Now take a look at just the past 6 years - from 2015 to 2021. That's an increase in the number of firms from circa 8,000 globally to over 12,000. In other words there has been a greater than 50% increase in the number of active firms in just 6 years.

Growth in private capital firms 1990 - 2021

Now take a look at the returns being delivered from the Private Markets (NAV), versus Public Markets (Market Cap), over a similar period. You can see that the pace of growth in Private Capital return is significant. Not only is it significant but it is significantly outpacing Public Market returns. Investors chase yield, they want returns, many want outsized, uncorrellated returns. This is where Private Capital is winning. These returns are causing seismic shifts in the way that investors view the private capital markets and the way in which Private Capital firms are responding.

Private Capital market returns versus Public market returns

Now let's look at just one of the ways Private Capital Firms have responded. In 2000, it was likely that a private capital firm had a highly specialized singular focus. In 2020, it's far more likely that they are a multi-offering, diversified (either at a sub-asset-class level, or at an Asset Class level) firm, seeking to provide an array of offerings to the significant number of newly accredited investors in the market. With 13% of all american housholds now meeting the 'Accredited Investor' criteria, there are a lot more investors, chasing returns and hungry for Private Capital offerings.

Product proliferation in Private Capital

And finally, let's look at allocations to private capital. They have steadily gained pace and continue to grow in percentage terms each year, with ranges from the early 20's to as high 50-60% with long-term patient capital. Private capital investments are on the rise, and both Private Equity and Venture Capital firms need to significantly transform their business to take advantage of these changes, and protect the clients they already have.

Allocations to Private Capital 2008-2019

How do PE and VC firms respond to this opportunity?

The answer is simple. You have to simplify and digitize your operations from end-to-end. Give these Investors the kind of service they expect and deserve. Think about their experience from the time that you first reach out to them to the time that they become an investor. In summary - you need to care about the overall experience they have with you as an investor.

We call this 'Investor Lifecycle Management' and the benefits are transformative for every stakeholder in the process.

Improved onboarding by 4-5X

Automate compliance by embedding it in your system processes

Improve access to your offerings by accellerating 'time to view' by 4-5X

Get Subscription Documents automated, pre-populated and signed quicker - 82% sign in less than 1 day

Reduce NIGO errors by 80+%

Faster Funding/Capital Calls, often 5-10X faster

Improve service and reduce your costs by 5-20X by streamling, automating and providing self-service options for your investors

Reduce the time it takes to get from 'Form-to-funded' from 6+ weeks to <5 Days

Below is a simplified step by step breakdown of each primary stage, the improvements that can be had with Investor Lifecycle Management, and the speed and efficiency with which you can raise capital.

Investor Lifecycle Management

Interested in learning more?

Our Latest Articles

Private Capital and Alternatives Market in 2024: The 10 Major Themes that defined the year

Private Capital and Alternatives Market in 2024: The 10 Major Themes that defined the year

Private Capital and Alternatives Market in 2024: The 10 Major Themes that defined the year

Private Capital and Alternatives Market in 2024: The 10 Major Themes that defined the year

How the upcoming Trump Presidency could positively impact the Private Capital Markets

How the upcoming Trump Presidency could positively impact the Private Capital Markets

How the upcoming Trump Presidency could positively impact the Private Capital Markets

How the upcoming Trump Presidency could positively impact the Private Capital Markets

Investor Deal Flow Management with a CRM Platform

Investor Deal Flow Management with a CRM Platform

Investor Deal Flow Management with a CRM Platform

Investor Deal Flow Management with a CRM Platform

Our Modules

Our Modules

Our Modules

Our Modules